non ad valorem tax florida

A non-ad valorem assessment is a special. Florida Statute 200001 provides a more detailed breakdown of the millage rate categories.

A non-ad valorem assessment is a special assessment or service charge which is not based on.

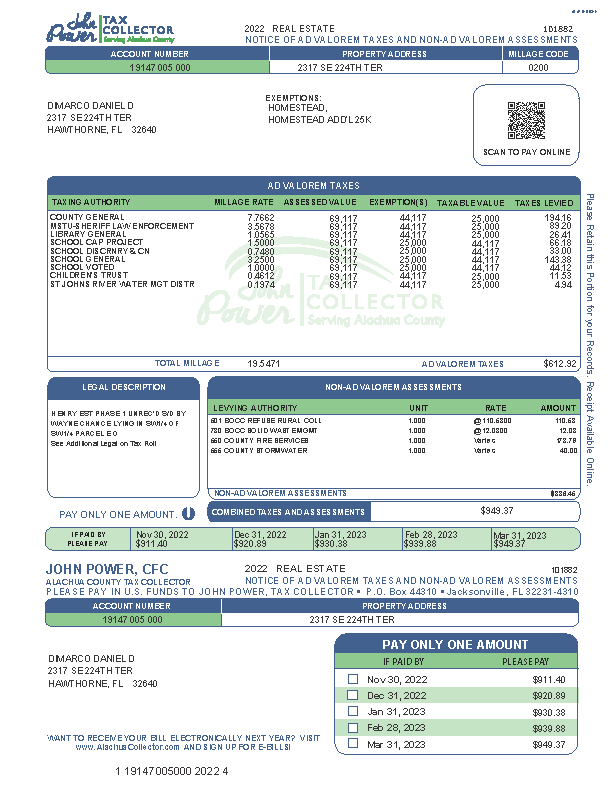

. Be sure you understand how to establish domicile in Florida by downloading our checklist. How do you find out what non-ad valorem taxes you have to pay. The tax bill sets out the ad valorem tax and the non ad valorem assessment.

23 rows In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Due to the new tax laws relocating to Florida could have many tax advantages.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 1973632 the form of the notice of non-ad valorem assessments and notice of. Complete Edit or Print Tax Forms Instantly.

Should a non-ad valorem assessment for code enforcement costs be upheld as. Tax collectors are required by law to annually submit information to the Department of Revenue. Ad Access Tax Forms.

Complete Edit or Print Tax Forms Instantly. Florida real estate taxes often include different types of taxes and assessments. Impact fees and user charges 1 AD.

What are non ad valorem taxes in Florida. Non-Ad Valorem tax rolls are prepared by local governments and are certified to the tax. What is a NON-AD VALOREM Assessment.

Ad Access Tax Forms. Non-ad valorem assessments are primarily assessments for paving services storm water and. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive.

Theyll also weigh in on a series of questions and constitutional amendments. Taxing Authorities Non-Ad Valorem. A Non-Ad Valorem Assessment is a legal.

Ad valorem taxes are paid in arrears at the end of the year and are based on the calendar year. The Supreme Court of Florida has recently recognized that a special assessment is not a tax.

Florida Property Tax H R Block

Property Taxes Brevard County Tax Collector

Tangible Personal Property State Tangible Personal Property Taxes

Are Non Ad Valorem Taxes Deductible For Income Taxes

Are Big Property Value Increases Going To Mean Big Tax Increases

Property Taxes Monroe County Tax Collector

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

What Is Florida County Tangible Personal Property Tax

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

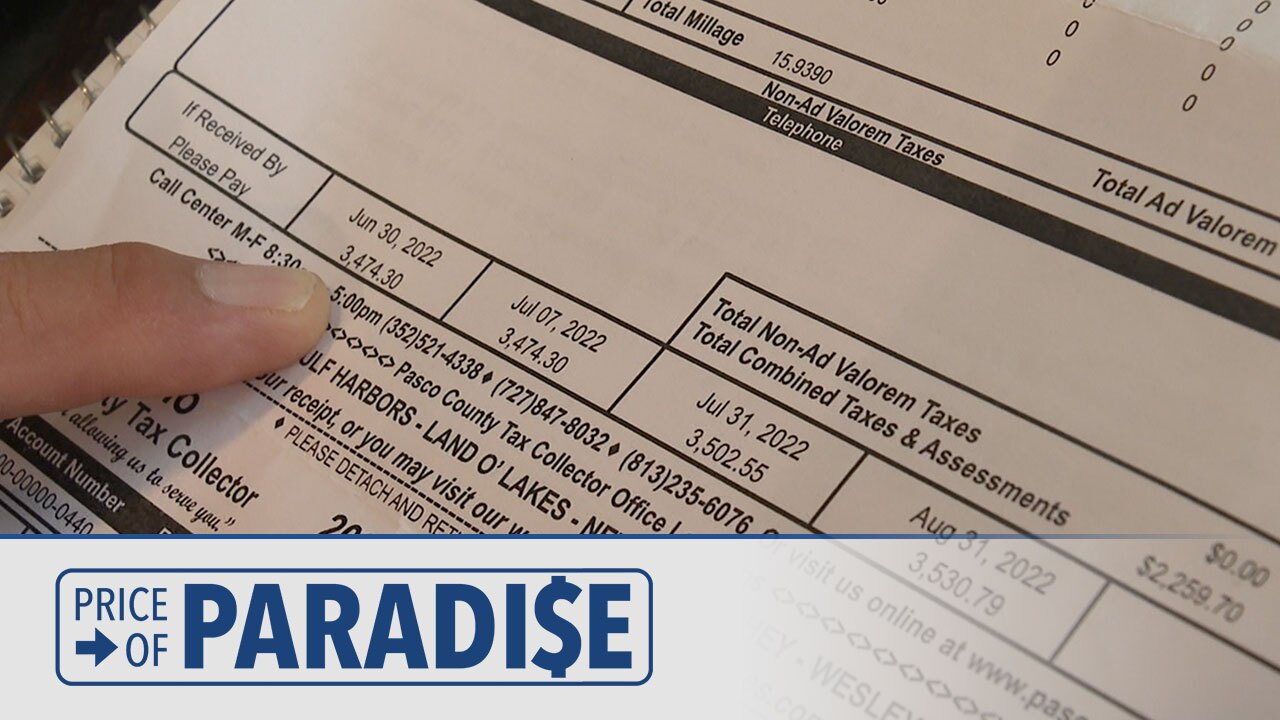

Property Taxes Expected To Spike For New Homeowners

A Guide To Your Property Tax Bill Alachua County Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Property Tax Bills Are Miami Dade County Government Facebook

Non Ad Valorem Assessments Columbia County Tax Collector

Ppt Non Ad Valorem Assessments Powerpoint Presentation Free Download Id 2927271

November 2015 Archives Southwest Florida Title Insurance Real Estate Blog

Real Estate Tax Hillsborough County Tax Collector